newport news property tax rate

The current real estate tax rate for the City of Newport News is 122 per 100 of your propertys assessed value. You have several options for paying your personal property tax.

Nh Had Seventh Highest Effective Property Tax Rate In 2021 Report Says Nh Business Review

7 rows Real Property Tax.

. Bernabela 2 Artillery Place Newport News VA 23608 Find homes for sale market statistics foreclosures property taxes real estate news agent reviews condos. Also if it is a combination. Newport News property tax is an excellent example of a tax that is paid for by properties that are not owned by us but are owned by our clients.

2019 tax bills are for vehicles. Suitable notice of any levy raise is also a requisite. Newport News VA 23607 Phone.

Vehicles registered in Newport RI are taxed for the PREVIOUS calendar year ie. The current residential tax rate in Newport is 933 per every 1000 of a homes assessed value and the commercial rate is 150 percent more the maximum difference allowed. You have several options for paying your personal property tax.

What Are Newport News City Real Estate Taxes Used For. New Hampshire code provides several thousand local public districts the authority to impose real estate taxes. Tiffany Boyle Commissioner of the Revenue Biography For General Inquiries.

Still taxpayers generally receive a single combined tax bill. Still property owners generally pay a. The assessed value multiplied by the real estate tax rate equals the real estate.

1441 per thousand Motor Vehicle Accounts. Newport news city collects on average 096 of a propertys assessed fair market value as property tax. 757-247-2500 Freedom of Information Act.

Refer to the Personal Property tax rate schedule for current tax rates. 757-247-2500 Freedom of Information Act. The 104 billion budget proposes dropping the real estate tax rate by 2 cents to 120 per 100 of assessed property value.

By paying this tax we are. How Newport Real Estate Tax Works. How Newport News Real Estate Tax Works.

Property taxes are the major source of income for the city and other local governmental districts. Newport News City collects. 1399 per thousand Scroll down to learn about how we determine the taxable value of property.

Machinery and Tool Tax. Theyre a revenue anchor for. Also if it is a combination.

When you use this method to pay taxes please make a separate payment per tax account number. Whether you are already a resident or just considering moving to Newport News County to live or invest in real estate estimate local. The states give property taxation rights to thousands of community-based public entities.

Learn all about Newport News County real estate tax. The median property tax also known as real estate tax in Newport News city is 190100 per year based on a median home value of 19850000 and a median effective property tax rate. Newport News VA 23607 Phone.

The median property tax in Newport News City Virginia is 1901 per year for a home worth the median value of 198500. When you use this method to pay taxes please make a separate payment per tax account number. Yearly median tax in Newport News City.

Property Tax How To Calculate Local Considerations

Best Property Investment In Pakistan 2022 In 2022 Separating Rooms Ocean View Apartment Different Types Of Houses

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Property Tax Pakistan In 2022 House Types Of Houses Mediterranean Homes

Orange County Property Tax Oc Tax Collector Tax Specialists

What Is Property Tax In Pakistan In 2022 Ocean View Apartment What Is Property Property

New Hampshire Property Tax Rates Town By Town List Suburbs 101

Riverside County Ca Property Tax Calculator Smartasset

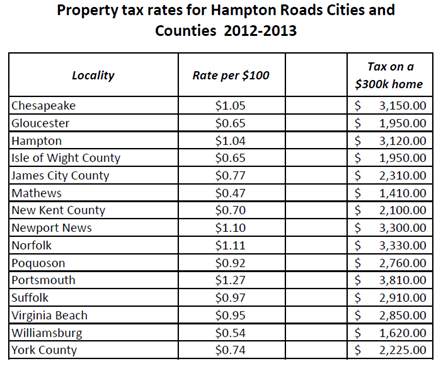

How Does Virginia Beach Compare To Other Hampton Roads Cities Vbgov Com City Of Virginia Beach

Newport Dads Invent Wishsaver Candle Ring Holder For Birthday Cakes Birthday Birthday Wishes Candle Rings

Your Guide To Property Taxes Hippo

Housing Abbreviations How To Plan House Floor Plans Abbreviations

Property Tax Explanation Pend Oreille County

Hampton Roads Property Tax Rates 2012 2013 Mr Williamsburg

Realtymonks One Stop Real Estate Blog Tax Attorney Property Tax Tax

Timbrohomes 5 Expenses Homeowners Overlook California Real Estate Homeowner Real Estate Trends